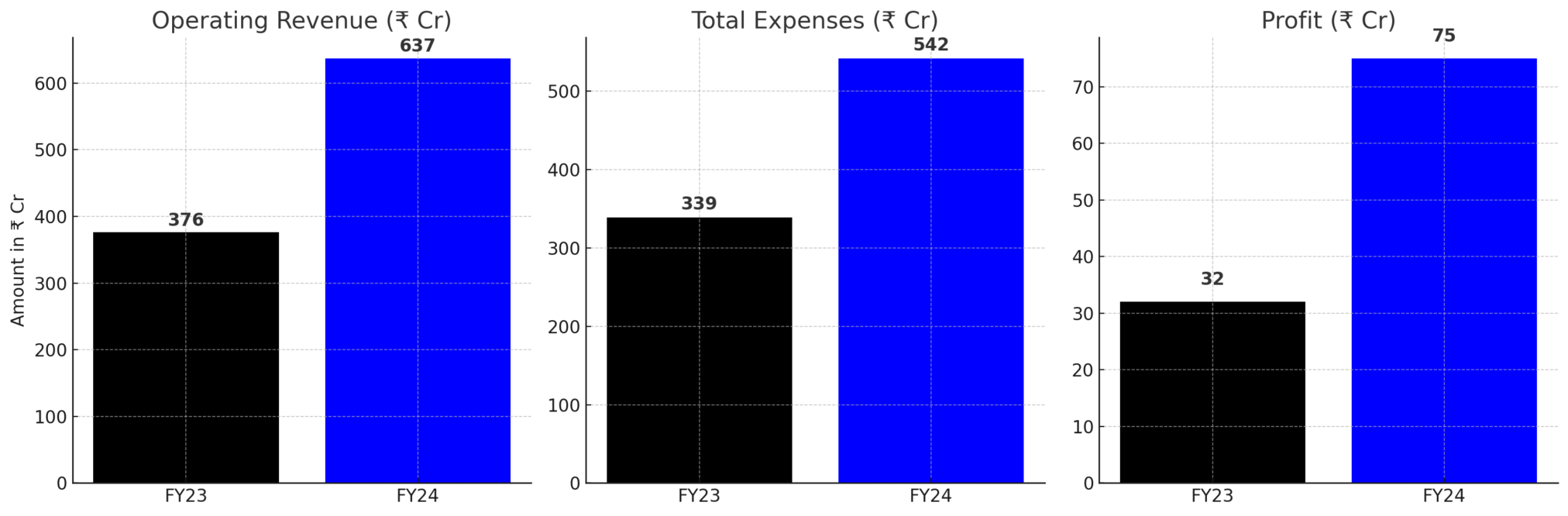

Rare Rabbit, a leading premium fashion brand, has demonstrated remarkable financial growth in FY24, with its operating revenue surging by 69.4% to ₹637 crore, up from ₹376 crore in the previous fiscal year. Meanwhile, the company’s net profit skyrocketed 134% (2.3x) to ₹75 crore, compared to ₹32 crore in FY23. The impressive growth was driven by a significant rise in sales and improved operational efficiencies.

Company Overview & Business Model

Founded in 2015 and operated by The House of Rare, Rare Rabbit has established itself as a premium men’s fashion brand, offering a diverse range of clothing, including shirts, polos, T-shirts, trousers, and jackets. Known for its luxury craftsmanship and contemporary designs, the brand caters to urban professionals and high-fashion enthusiasts.

Rare Rabbit follows a direct-to-consumer (D2C) and omnichannel strategy, operating through exclusive brand outlets (EBOs), multi-brand stores, and online platforms such as its own website and major e-commerce marketplaces. The brand has also expanded into women’s fashion under “Rareism” and is planning a children’s clothing line, “Rare Ones.”

Brand Portfolio Under The House of Rare:

- Rare Rabbit – Men’s Fashion

- Rareism – Women’s Fashion

- Rare Ones – Children’s Fashion (launched in October 2024)

Read more: BYTES Secures ₹20 Lakh Grant to Revolutionize Two-Wheeler Safety

Financial Performance & Revenue Breakdown

Rare Rabbit’s revenue primarily stems from product sales, supplemented by ₹5 crore in interest income, bringing the total income for FY24 to ₹642 crore.

Key Expense Breakdown (YoY Growth):

- Material costs: ₹208.4 crore (up 53%)

- Employee benefit expenses: ₹78 crore (up 95%)

- Advertising expenses: ₹93 crore (up 45%)

- Rent and commission expenses: Up 62% and 58%, respectively

- Total expenses: ₹542 crore, compared to ₹339 crore in FY23 (up 59.9%)

Despite rising expenses, Rare Rabbit’s revenue growth outpaced its costs, resulting in a substantial increase in profitability.

Key Financial Ratios & Profitability Improvement

- EBITDA Margin: Increased from 14.7% in FY23 to 19% in FY24

- Return on Capital Employed (ROCE): Jumped from 42.02% to 52.15%

- Cost per ₹1 revenue earned: Improved from ₹0.90 in FY23 to ₹0.85 in FY24

- Cash & Bank Balances: ₹2 crore

- Current Assets: ₹349.5 crore

Funding & Growth Strategy

According to TheKredible, Rare Rabbit has raised approximately $24 million in funding to date, including a recent ₹50 crore investment from A91 Partners, its lead investor. The company’s strategy of premium pricing with minimal discounting has enabled it to build a strong brand identity, setting it apart from other fast-fashion retailers.

Future Outlook: On Track for ₹1,000 Crore Revenue in FY25

Rare Rabbit’s steady growth and strategic positioning in the high-fashion market have placed it in a good position to expand further. The company is viewed by industry analysts to reach ₹1,000 crore in topline by FY25, spearheaded by healthy profitability.

It may be in unicorn status at this scale, with a valuation of a billion dollars without needing to be acquired. If the brand sustains its momentum, it will solidify its position as a dominant player in India’s premium fashion market.

Financial Performance Overview (FY23 vs. FY24)

Revenue, Expenses & Profit Trends:

| Metric | FY23 (₹ Cr) | FY24 (₹ Cr) | YoY Growth |

|---|---|---|---|

| Operating Revenue | 376 | 637 | 69.4% 📈 |

| Total Expenses | 339 | 542 | 59.9% 📈 |

| Net Profit | 32 | 75 | 134.4% 📈 |

Key Financial Ratios & Performance Metrics:

| Metric | FY23 | FY24 | Change |

|---|---|---|---|

| EBITDA Margin | 14.7% | 19% | ▲ 4.3% |

| ROCE (Return on Capital Employed) | 42.02% | 52.15% | ▲ 10.13% |

| Expense per ₹1 Revenue | ₹0.90 | ₹0.85 | ▼ ₹0.05 |

| Cash & Bank Balances (₹ Cr) | 1 | 2 | ▲ 100% |

| Current Assets (₹ Cr) | 201 | 349.5 | ▲ 73.9% |

Rare Rabbit’s impressive growth in FY24, driven by strategic expansion and strong financial performance, positions it as a leading premium fashion brand. With its foray into women’s and kids’ fashion, the company is on track to surpass ₹1,000 crore in revenue by FY25, solidifying its market dominance and potential unicorn status.

Read more: India’s Smartphone Exports Surge to Record ₹1.5 Lakh Crore